when will capital gains tax increase be effective

2022 capital gains tax rates. But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is.

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

In an effort to tax wages and wealth at the same rate Biden wants to put the top income tax rate at the Obama-era 396 and also have the same 396 capital-gains rate apply to households.

. A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase price. While the proposed increase is not as severe as originally feared the top capital gains tax would see an increase from 20 to 25. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28 2021 although it was not widely.

Long-term capital gains LTCG tax rates for tax year 2021. Web It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains. In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987.

Capital gains on the. Currently the capital gains rate is 20 for. The effective date for this increase would be September 13 2021.

MAXIMUM TAX RATE ON CAPITAL GAINS. At the state level income taxes on capital gains vary from 0 percent to 133 percent. This resulted in a 60 increase.

House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee. This resulted in a 60. Personal Income Tax I.

The proposal would increase the maximum stated capital gain rate from 20 to 25. These gains are taxed as per the ordinary income tax rate 10 12 22 24 32 35 or 37. Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment.

The top rate would be 288 when. 2021 capital gains tax calculator. Capital gains taxes on.

Analysts at Penn-Wharton concluded that Bidens proposed capital gains tax increase would lower federal revenue by 33 billion. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Capital Gains Tax.

What If Bidens Capital Gains Tax Is Retroactive. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. Long-Term Capital Gains Taxes.

If the effective date is retroactive to April 2021 it will be too late for investors to sell to avoid the tax increase. Ive found many sites that list the current US. If the top federal capital gains rate rises to 434 percent this would raise the combined tax rate on long-term capital gains to 484 percent.

With average state taxes and a 38 federal surtax. Web Capital Gains Tax Rates 2021 To 2022. Note that short-term capital gains taxes are even higher.

President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends. Youll owe either 0 15 or 20. In the case of long-term capital gains you are taxed at rates of 0 15 or.

But I cant find any explanation whether these tax rates are marginal or.

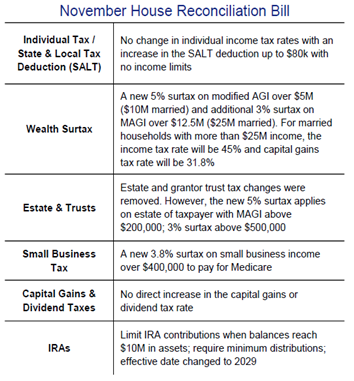

Washington Policy Research Nov 16 2021 Private Wealth Management

Analyzing Biden S New American Families Plan Tax Proposal

How Are Capital Gains Taxed Tax Policy Center

In Case Of Capital Gains Tax Hike Don T Panic Thinkadvisor

Advisers Blast Biden S Retroactive Capital Gains Proposal

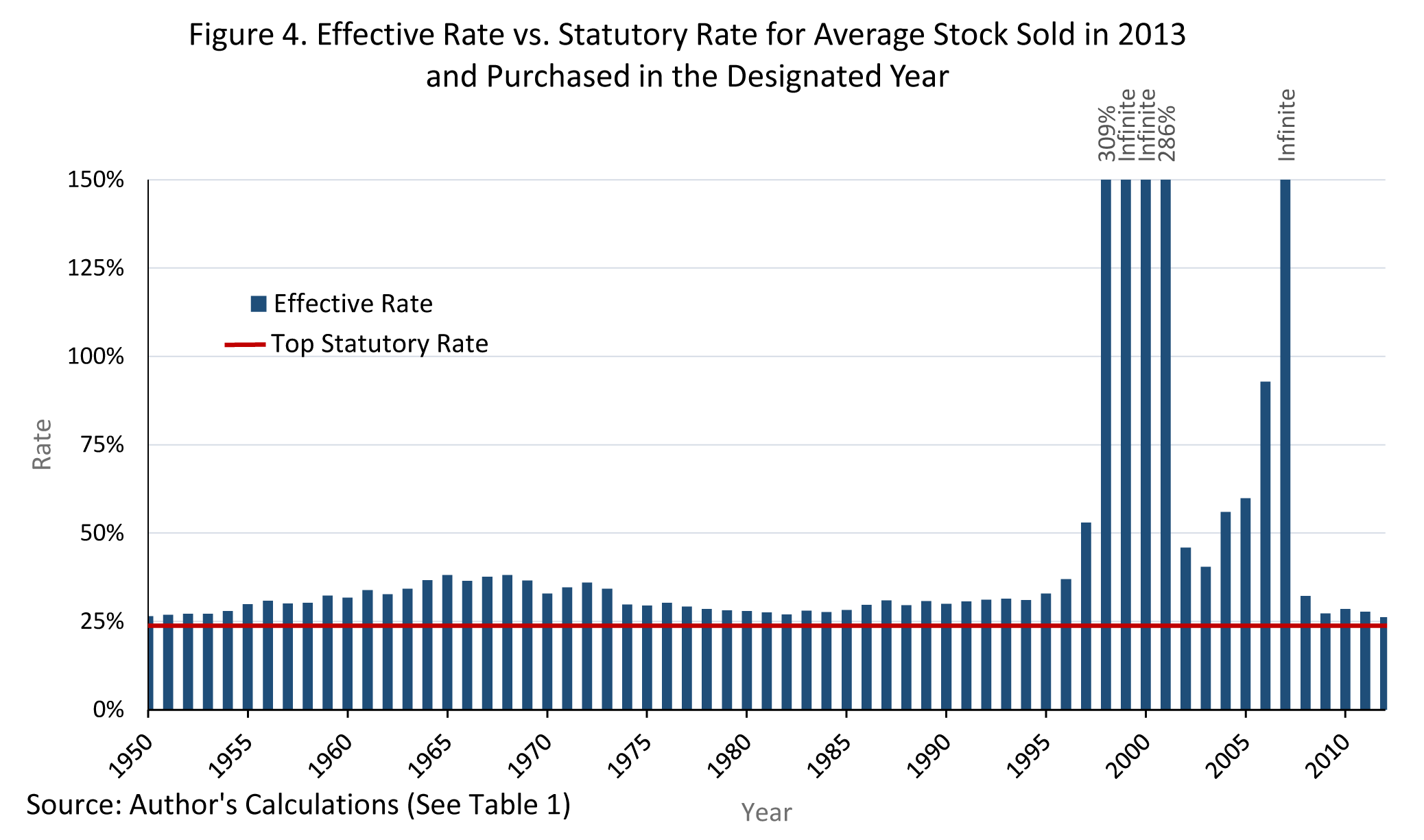

Inflation Can Cause An Infinite Effective Tax Rate On Capital Gains Tax Foundation

Managing Tax Rate Uncertainty Russell Investments

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

What Is The Difference Between The Statutory And Effective Tax Rate

Capital Gains Tax Guide Napkin Finance

Estimated Income Tax Spreadsheet Mike Sandrik

Capital Gains Vs Ordinary Income The Differences 3 Tax Planning Strategies Kindness Financial Planning

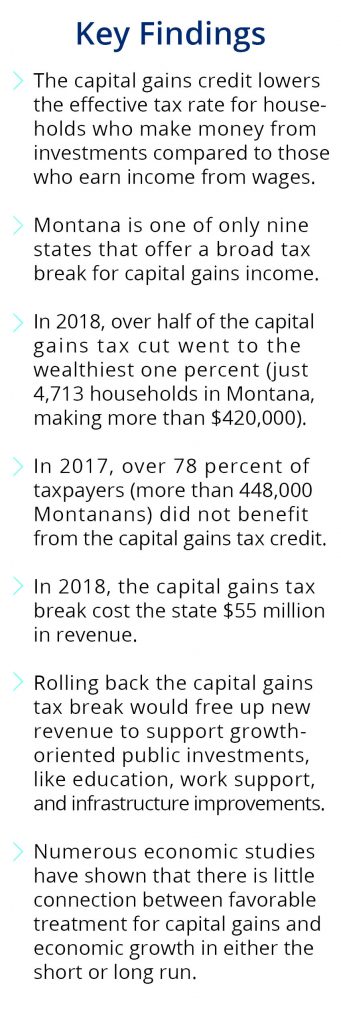

Capital Gains Tax Credit Valuing Wealth Over Work In Montana Montana Budget Policy Center

Tax Rates Vs Tax Revenues Mercatus Center

Comparing Income Corporate Capital Gains Tax Rates 1916 2011 Visualizing Economics

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

:max_bytes(150000):strip_icc()/what-is-the-capital-gains-tax-fdeabd19e84849e9b12ebdadc1023859.png)